The rise of the machines: annals in high-speed trading

Several years ago, I served as an expert witness in a trade secrets lawsuit involving algorithmic high-speed trading and learned some fascinating things in the process (most of which I can’t talk about). So it was with some interest that I read this article about the market’s near-instantaneous reaction to the Federal Reserve’s decision not to “taper” its on-going security purchases:

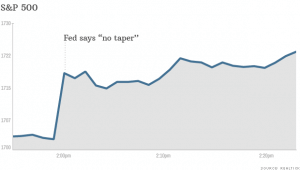

The market erupted Wednesday afternoon immediately after the shocking “no taper” news from the Federal Reserve. The reaction was so fast, it left many people wondering how any human could have read and comprehended the Fed statement that quickly.

Even though the Fed waited until the third paragraph to say that it was not yet ready to scale back its bond buying program, stocks surged on a big spike in volume within microseconds, or one thousandth of a second of the release. . . .

Such is the effect of so-called high speed trading, where computers can be programmed to unleash millions of trades per milliseconds. Algorithms can react before any human could possibly digest information, much less trade on it.

What the article doesn’t point out is that many algorithmic trading systems monitor certain news and data feeds, parsing the text and responding to key words. I’m sure there were many such systems that were set up to receive the September 18 Federal Reserve press release electronically and to react based on the presence or absence of certain words or phrases. Such analysis on a powerful system of a mere 768 words would only take microseconds, in particular looking for and interpreting this sentence:

Accordingly, the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month.

This wouldn’t even require sophisticated analysis, since it matches word-for-word this text from the July 31, 2013 FOMC press release:

…the Committee decided to continue purchasing additional agency mortgage-backed securities at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month.

Meanwhile, many other trading algorithms are set to react to abrubts changes in market trading, and so they would start buying in reaction to the buying initiated by the text-analyzing systems, and so on — a “flash surge”, the opposite of a flash crash.

The article goes on to note:

Now if you are an investor that’s in stocks for the long haul, you don’t have much to complain about. Your 401(k) likely rose in value on Wednesday. But if you are a trader trying to time sudden turns in the market, it’s hard to beat the machines.

Yes. Yes, it is.

![The Meltdown/Spectre CPU bugs: a dramatic global case of the “Unintended Consequences” pattern [UPDATED 4/4/18] The Meltdown/Spectre CPU bugs: a dramatic global case of the “Unintended Consequences” pattern [UPDATED 4/4/18]](http://bfwa.com/wp-content/uploads/2018/01/intel-cpu-150x150.jpg)