BanxCorp v. Costco et al. — Can you copyright the result of a calculation?

From 2011 to 2013, I served as an expert witness in BanxCorp d/b/a BanxQuote v. Costco Wholesale Corporation et al., a copyright infringement case in the US District Court, Southern District of New York. To quote from the summary judgment opinion issued in this case by Judge Kenneth M. Karas (note — I have omitted footnotes and citations from these quotes):

Consider the percentage “3.95%.” It seems to be a totally ordinary percentage. It is the amount by which Eastern Michigan University increased its tuition and fees for the 2012–13 school year relative to the previous one. It is how much the Mayor of Poughkeepsie proposes to increase the city tax levy for 2014. It is the amount by which sugar prices rose in India one day in November 2012. And, according to Plaintiff Banxcorp, it was the United States national average interest rate for five-year certificates of deposit as of December 21, 2005.

For Plaintiff, then, 3.95% is not such an ordinary percentage. Plaintiff initiated this lawsuit in part because it claims it has a valid federal copyright in that particular percentage — or, at least, that it has a copyright in its series of percentages of national average interest rates, of which 3.95% on December 21, 2005 is one part. And it claims that it is entitled to substantial money damages because Defendants Costco and Capital One — a large retailer and a large bank, respectively — unlawfully copied those percentages in a series of individual advertisements touting how much higher their particular deposit rates were than the national average, as reported by Plaintiff. Defendants’ copying of individual averages is conceded; at issue for the copyright claim in this case is whether the percentages themselves are entitled to federal protection under the Copyright Act.

The gist of the case is that over a period of years, BanxCorp published on its public website what purported to be representative national averages for interest rates offered by banks for various financial instruments. As noted above, Costco and Capital One cited two of those published values — the 5-year CD rate, and the money market rate — in advertising certain Capital One financial products being offered in a joint-marketing effort with Costco. BanxCorp sued for copyright infringement and unjust enrichment.

I was retained by Defendants via their counsel, Nancy Mertzel (initially at Donovan & Yee, and subsequently at Schoeman Updike). Plaintiffs eventually produced source code and database files, which I then examined, specifically to answer two questions:

- How did BanxQuote calculate its national averages for money markets and 5-year certificates of deposit?

- To what degree did the banks that were used to calculate the national averages change over time?

These questions were key to this case, because BanxCorp claimed that these “weighted” averages were calculated via “complex algorithms” and involved on-going human judgment and selection of which banks to use for the national average. As to what I actually found, let me quote again from Judge Karas’ (redacted public) opinion:

The way the Banxquote indices are produced reflects their stated purpose: They are mathematical averages of the rates advertised by certain major financial institutions, updated at least weekly. Thus, a former software developer at Banxcorp named Abu Thomas testified that “if there are five banks,” then, to calculate its average rate, Banxcorp would “take the average of five banks.” (Lipkis Decl. Ex. 11, at 41.) The deposition continued:

Q: So you take the rate that each of the five banks is paying on money markets, add it up, and divide?

A: Yes.

Q: Simple mathematical average?

A: Yes.

Q: Is there any weighting of the banks included in the national

average?

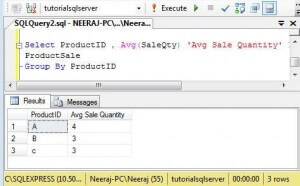

A: No.This method was independently confirmed by Defendants’ expert Bruce Webster, a computer scientist who examined Plaintiff’s source code. Webster noted that the national average values copied by Defendants “are simple mathematical averages of reported rates, with no weighting or other calculations involved.” In fact, only one actual computational function is used: a built-in database function called “AVG(),” which adds up the total of the values and divides by the number of entries. Plaintiff has proffered no evidence that would show that the computation process is any more complex.

As for the selection of which banks to use, it turned out that BanxCorp still had in-house — and produced to our side — the database tables that contained the actual values collected from the various banks and used to calculate these two averages during the period in question (a roughly 5-year period from 2002 to 2007). When I coordinated the table values with the source code, here’s what I found, as cited in Judge Karas’ opinion (via a declaration by Ms. Merzel):

From November 2002 to May 2007, for instance, the set of banks remained entirely consistent for the 5-year national average CD rate. That is, the input is simply the 5-year CD rate from “exactly the same set of banks, week after week, for 233 weeks.” The story is nearly the same for the other average relevant to this case, the national money market rate. For that average, Plaintiff made only three changes to the input banks from November 2002 to May 2007.

Because of this, Judge Karas denied Plaintiff’s copyright claims on multiple grounds (compilations, mergers, etc.), but he led off with this ruling:

Plaintiff’s averages are uncopyrightable facts

Plaintiff’s legal argument that any given individual average is protectable as a sufficiently original work withers away in light of the evidence of what Plaintiff’s data is and the factual findings explained above. Each average is a fact, plain and simple: It is the national average rate of interest offered by major U.S. banks on a given financial product at a given point in time based on publicly available data. That is how Plaintiff held out its averages over the relevant time period, how the media interpreted and reported on them, and how any relevant consumer would have understood them. . . .

Plaintiff has not created a genuine dispute of fact that the type of judgment that would infuse the data with “originality” goes into the calculation of each individual average. Rather, Plaintiff inputs the relevant rates and the software runs an average, which Plaintiff then publishes verbatim. And any “judgment” that went into the initial selection of banks was both extremely straightforward — one large bank in each state and the District of Columbia — and infrequent — Plaintiff’s list of banks did not change at all for four years for one of the averages at issue. Applying the specific three-part test stated above, (1) the raw data used to create the final value consists entirely of unprotectable facts; (2) the method of converting raw data into the final value is an industry standard and widely accepted as an objective methodology, because the method involves merely tracking the interest rates offered by large banks and computing a “simple mathematical average” of the inputted rates; and (3) the final value clearly attempts to measure an empirical reality. Each individual average is thus an uncopyrightable fact.

The entire opinion is worth reading. ..bruce..

![The Meltdown/Spectre CPU bugs: a dramatic global case of the “Unintended Consequences” pattern [UPDATED 4/4/18] The Meltdown/Spectre CPU bugs: a dramatic global case of the “Unintended Consequences” pattern [UPDATED 4/4/18]](http://bfwa.com/wp-content/uploads/2018/01/intel-cpu-150x150.jpg)